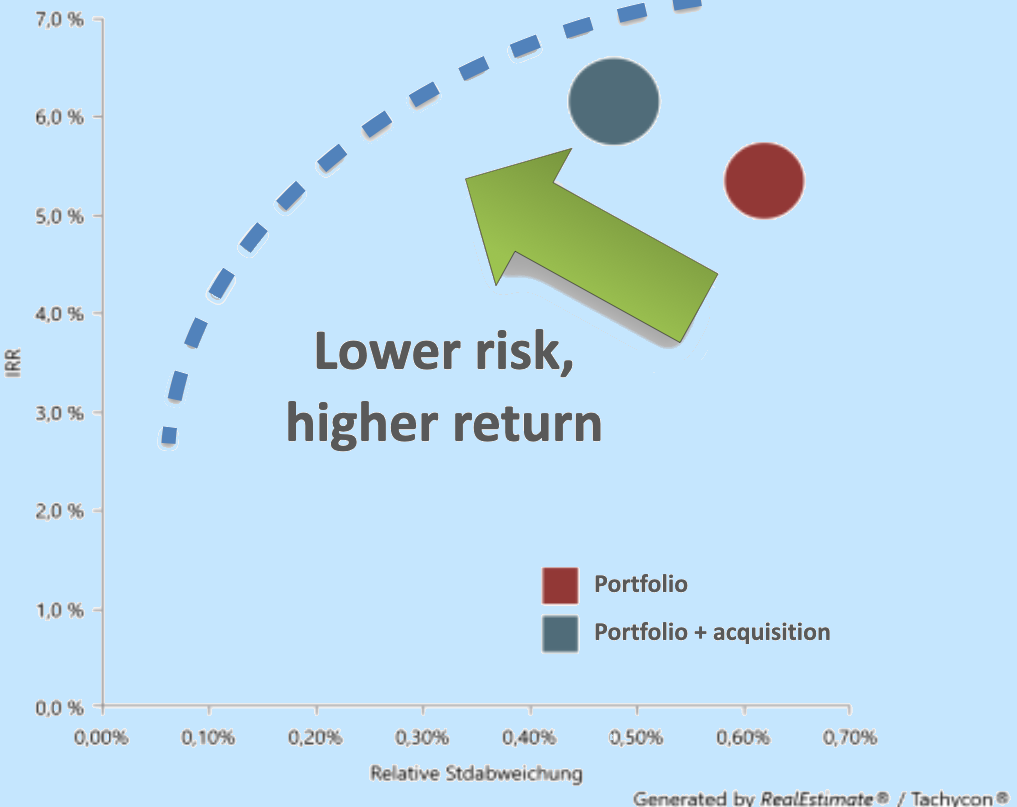

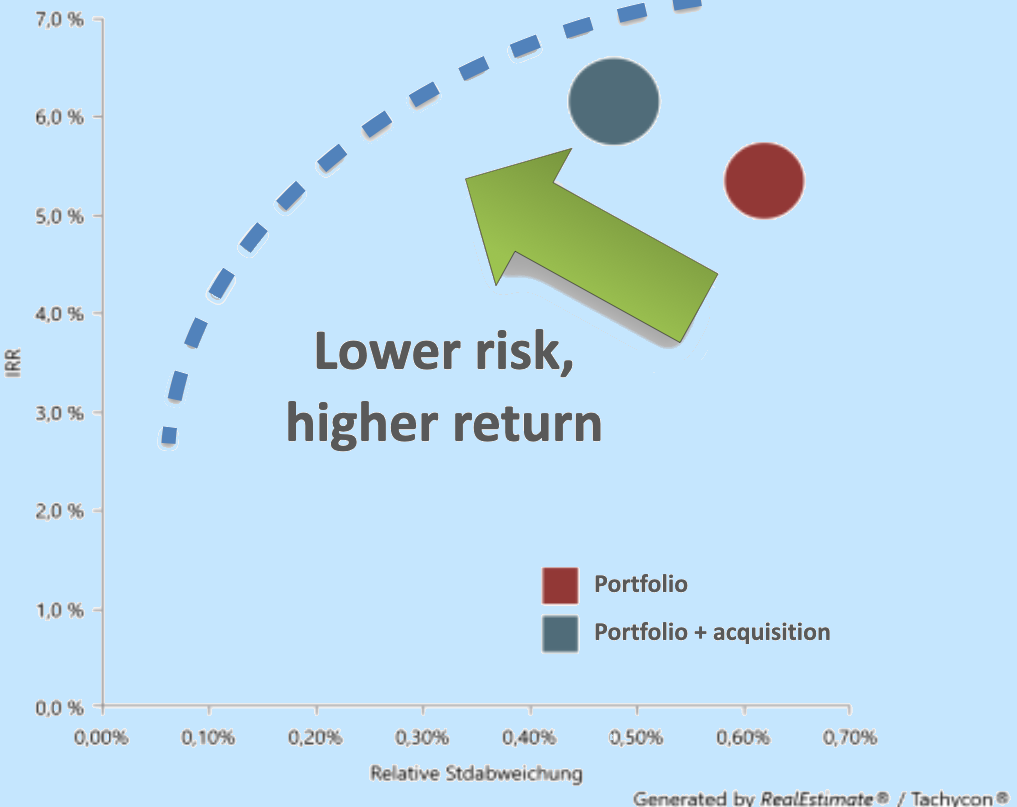

Framework for mapping of quantitative customer models Stochastic simulation provides distributions and statistics Transfer of capital market theory to illiquid asset classes USP: Ex ante cash flow based risk-return analysis

Representation of illiquid asset classes Property, Energy, Mortgage etc. Risk Management Services Asset Management Services

Cash flow analysis of investments along the value-creation chain Portfolio & scenario analysis, stress tests, IRR, VaR, LGD etc. Identification and analysis of critical objects USP: Cross Asset Benchmarking (universal language)

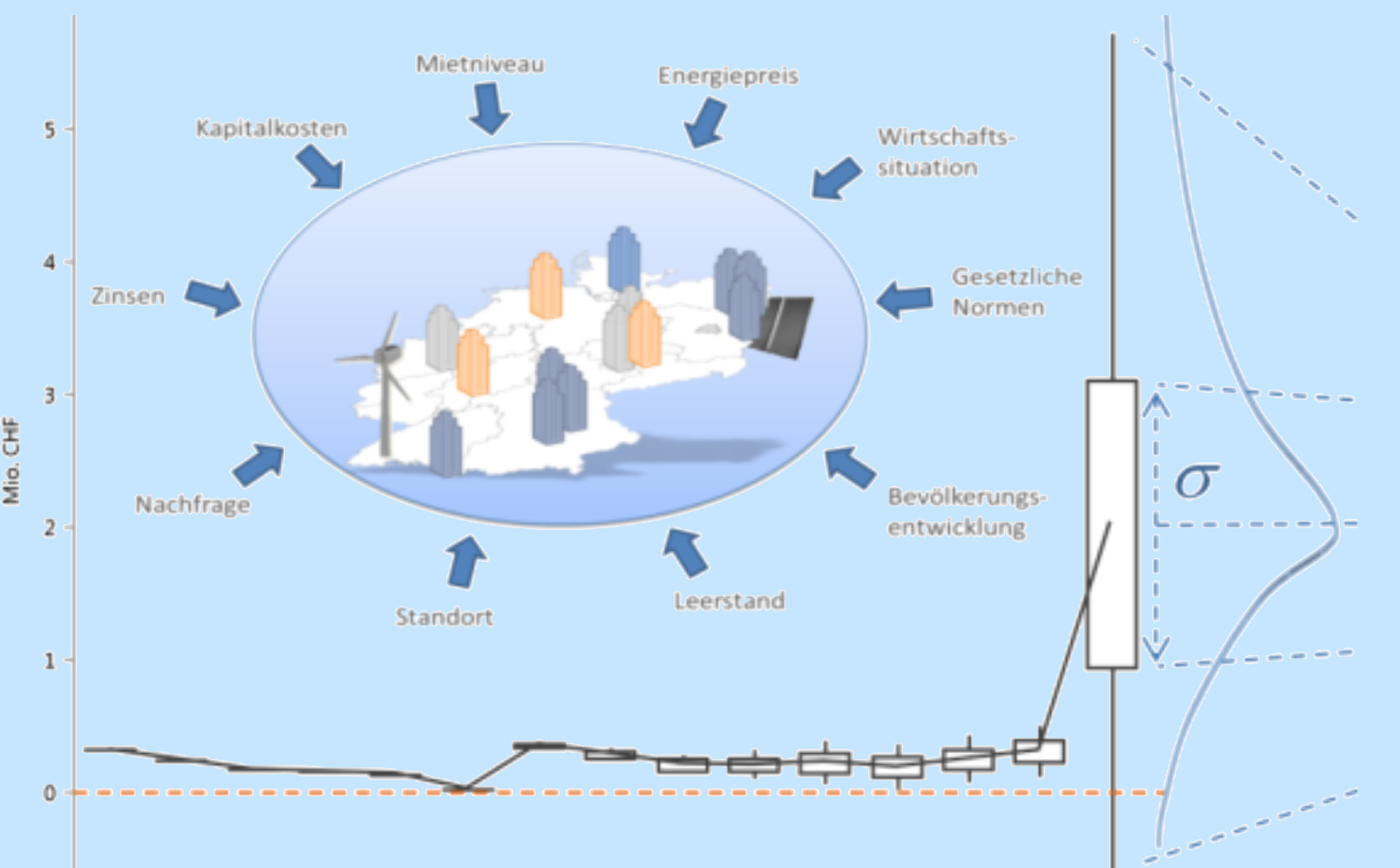

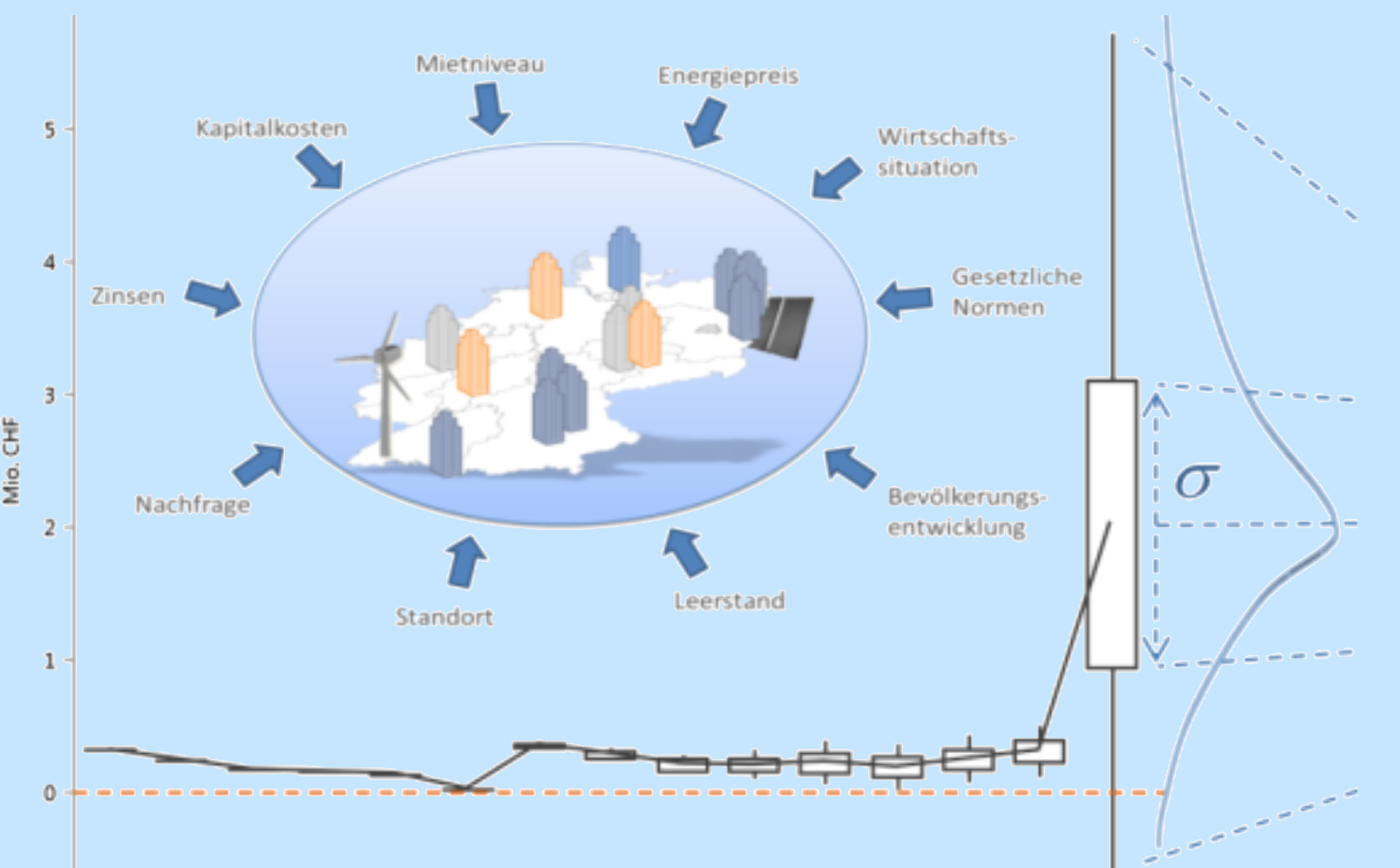

The analysis process is based on the simulation of future market developments within the framework of stochastic market models. Derived from these models, the corresponding future cash flows of properties and real estate portfolios will be simulated. The statistical distribution of the simulation results provide key risk figures such as risk corridors or value-at-risk. The procedure offers the linking of the macroeconomic market view with the micro level of the individual property as an essential unique selling point.